boulder co sales tax efile

Monthly returns are due the 20th day of month following reporting period. Use your existing username and password to log in to Boulder Online Tax System.

Jail improvements and operation.

. 13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. County road and transit improvements. How to Apply for a Sales and Use Tax License.

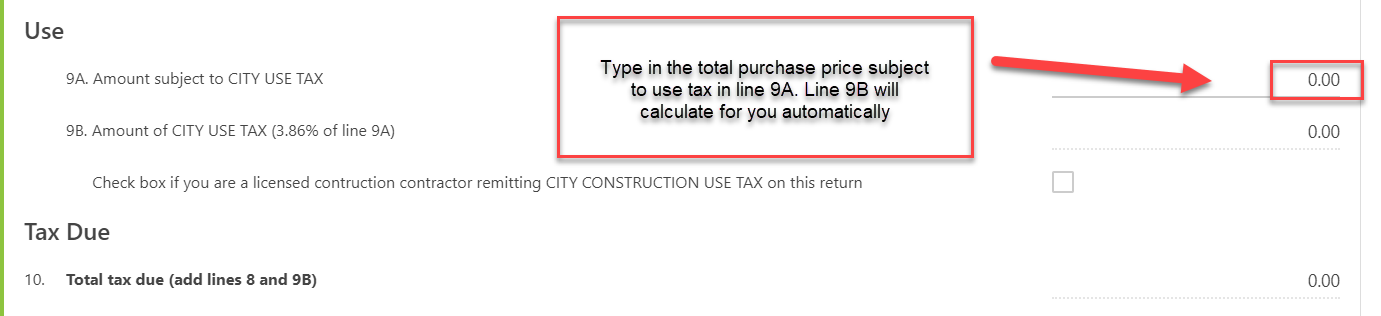

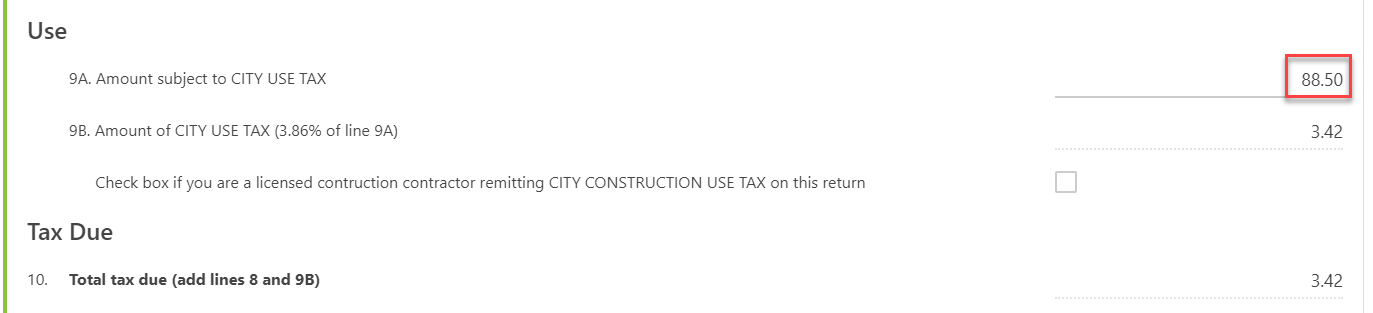

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item. Show details How it works Open the boulder online tax gentax cpc and follow the instructions Easily sign the city of boulder sales tax return with your finger Send filled signed boulder online tax system or save Rate the sales tax return boulder 46. For additional e-file options for businesses with more than one location see Using an.

The Boulder sales tax rate is. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax.

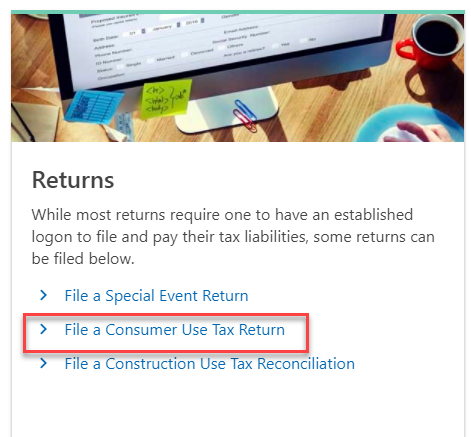

How to Pay Sales Tax Online Access the Boulder Online Tax System Visit the Boulder Online Tax System portal. If you have more than one business location you must file a separate return in Revenue Online for each location. For tax rates in other cities see colorado sales taxes by city and county.

Return the completed form in person 8-5 M-F or by mail. The minimum combined 2022 sales tax rate for Boulder Colorado is. 80301 80302 80303 80304 80305 80306 80307 80308 80309 80310 and 80314.

Email at salestaxbouldercoloradogov or send a message through Boulder Online Tax. The city use tax rate is the same as the sales tax rate. The Boulder Colorado sales tax rate of 8845 applies to the following eleven zip codes.

An alternative sales tax rate of 8855 applies in the tax region Lafayette which appertains to zip code 80301. Sales Tax Calculator of 80303 Boulder for 2019 The 80303 Boulder Colorado general sales tax rate is 8845. For questions about state taxes please call State of Colorado Taxpayer Services at.

Non-profit human service agencies. Use tax is not due to Boulder because a city tax was paid in excess of the amount that would have been due to Boulder. Senior Tax Worker Program.

Total Boulder County tax rate. File online tax returns with electronic payment options. The County sales tax rate is.

Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. Sent direct messages to Sales Tax Staff. This is the total of state county and city sales tax rates.

The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. The combined rate used in this calculator 8845 is the result of the Colorado state rate 29 the 80303s county rate 0985 the Boulder tax rate 386 and in some case special rate 11. If the project is located in Boulder County the County.

Boulder County Sales Taxes. This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax simplification effort. The Town Use Tax 35 is collected on the estimated material valuation at the time of permit.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations. Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers.

Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers. Did South Dakota v. This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax simplification effort.

City of boulder sales tax filing. Complete a Business License application or register for a Special Event License. If the Denver vendor is not licensed to collect Boulder sales tax use tax must be remitted to Boulder by the Boulder business.

The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. The colorado sales tax rate is currently. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

There are approximately 87879 people living in the Boulder area. There are a few ways to e-file sales tax returns. Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City.

300 or more per month. Longmont sales tax division 350 kimbark st longmont co 80501. Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely.

What is the sales tax rate in Boulder Colorado. Log in to the tax system or create an account. The boulder sales tax rate is.

Businesses that pay more than 75000 per year in state sales tax. The Colorado sales tax rate is currently. Sales tax returns must be filed monthly.

Sales tax must be remitted to the City of Boulder for the remaining 5 months of the lease. You do not need to log in if you are filing a Special Event Return. Wayfair Inc affect Colorado.

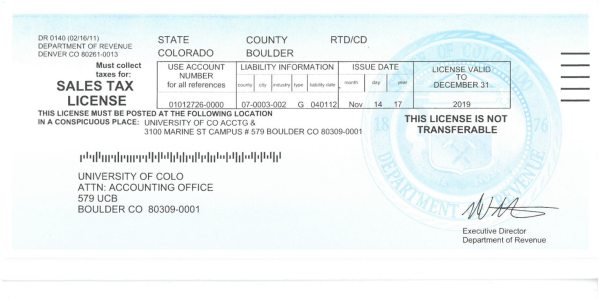

Sales Tax Campus Controller S Office University Of Colorado Boulder

Slow Tax Refunds Blamed For Taking Bite Out Of Restaurant Sales The Denver Post

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

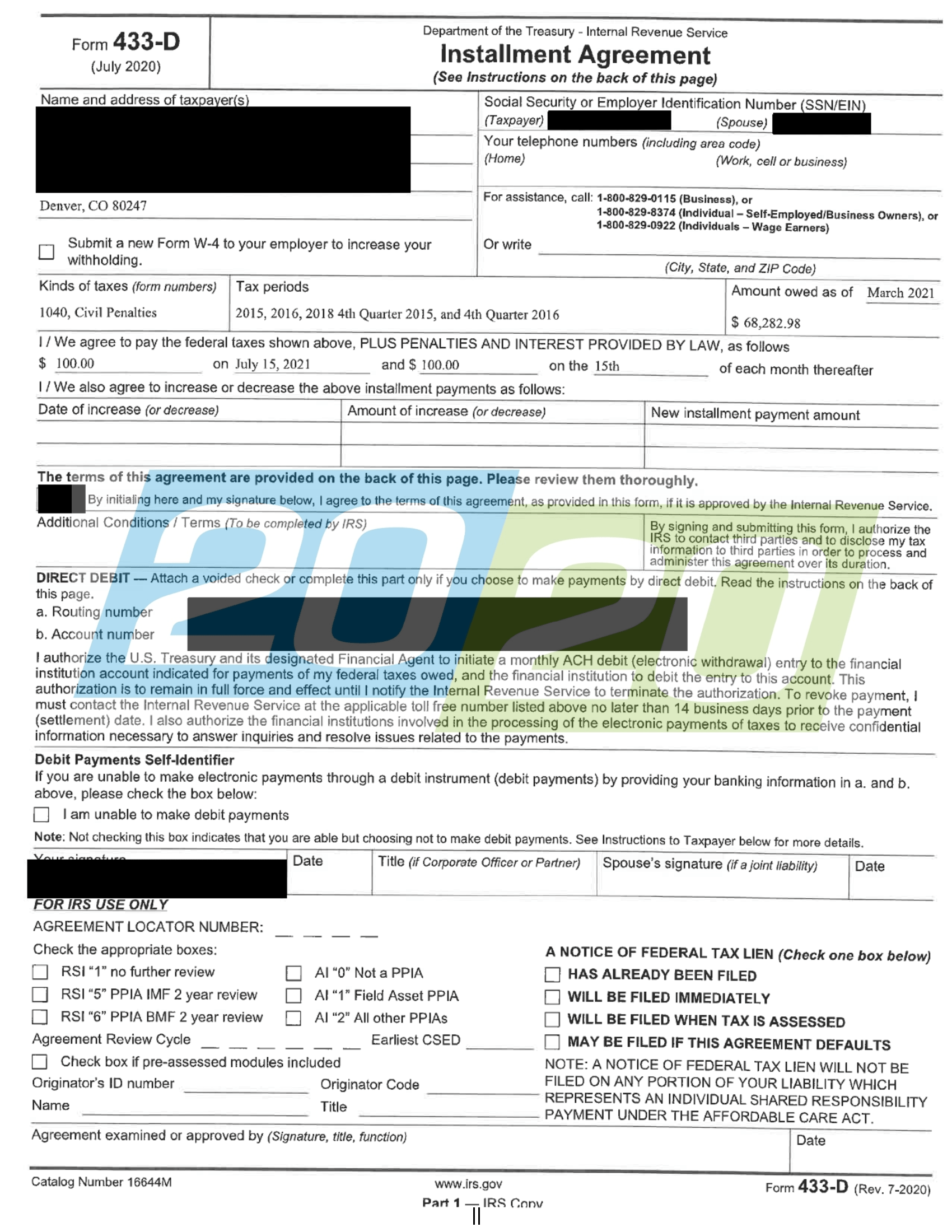

Tax Resolutions In Colorado 20 20 Tax Resolution

File Sales Tax Online Department Of Revenue Taxation

Tax Resolutions In Colorado 20 20 Tax Resolution

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales And Use Tax City Of Boulder

File Sales Tax Online Department Of Revenue Taxation

Here S How Much Coloradans Can Expect From Largest Taxpayer Refunds In 20 Years