cryptocurrency tax calculator reddit

However using those services isnt free and if you have thousands of transactions like myself the fees keep piling on and on with something like Koinly. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

There are cloud-hosting tools specifically designed for crypto miners.

. Free crypto tax calculator canada reddit. In 2021 it ranges from 10-37 for short-term capital gains and 0-20 for long-term capital gains. In my opinion at the tax year end you should NEVER have unrealized losses.

Mining software comparison gpu profitability ranking. Whatever method you use make sure you double check that everything is being calculated correctly. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

Tax treatment of cryptocurrency for income tax purposes. Blox supports the majority of the crypto coins and guides you through your taxation process. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets.

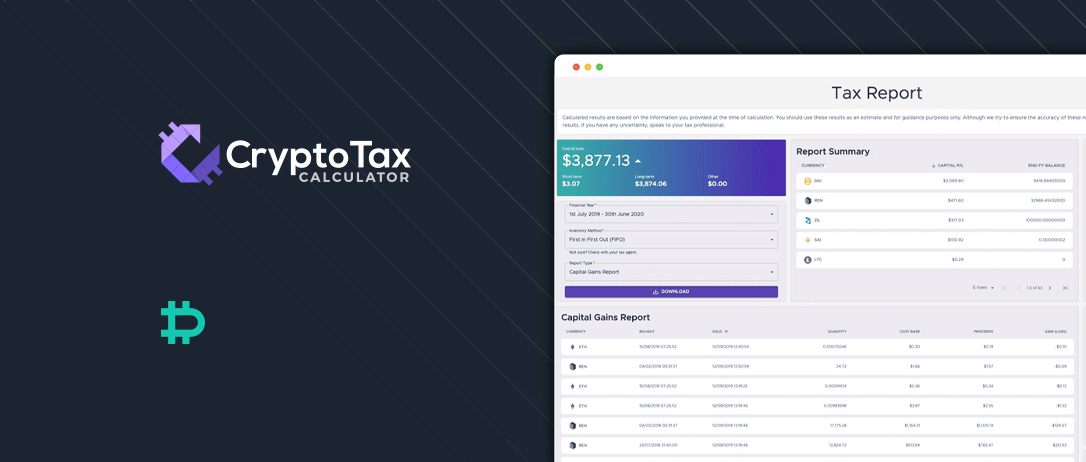

Its user-friendly dashboard makes it easy for you to calculate and report tax even if youre a beginner. The same issue exists with Crypto Tax Calculator httpscryptotaxcalculatorio. Cryptocurrency Tax Calculator Reddit.

Cryptocurrency Taxes Contents Big reasons. Tax treatment of cryptocurrency for income tax purposes. Crypto tax calculator reddit.

Heres an example of how to calculate the cost basis of your cryptocurrency. On the surface their. Cryptocurrency Tax Calculator Contents Mock sound wisdom.

Cryptocurrency investors in the usa will pay taxes to the irs on some transactions they make in 2020. The resulting number is your cost basis 10000 1000 10. Cryptocurrency investors in the usa will pay taxes to the irs on some transactions they make in 2020.

Calculate crypto taxes in 20 minutes. For the amount of work Im doing I might as well do it all myself. Personal use purchases with cryptocurrency less then a10000 are excluded from taxes.

Buying and selling crypto is taxable because the irs identifies crypto as property not currency. Get in touch however you would like. 10 to 37 in 2022 depending on your federal income tax bracket.

Our subscription pricing is per year not tax year so with an annual subscription you can calculate your crypto taxes as far back as 2013. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. We will also list some of the best crypto tax tools and software to help calculate your crypto earnings for the financial year trading on a cryptocurrency exchange in australia.

In order to calculate your digital asset tax. Whats crypto tax calculator crypto tax calculator is a software tool allowing users to calculate taxes on virtual currency trading activity. And there are plenty of others out there like Crypto Tax Calculator among others.

I am using Turbotax and the coin for below example is DAI. Heres a quick comparison of the the most popular software out there. It has a cost basis of.

Crypto tax calculator reddit. In the US the cryptocurrency tax rate for federal taxes is the same as the capital gains tax rate. In the US crypto-asset gains are calculated using two factors.

So unrealized gains 600 - 200125 275. Crypto tax software reddit. Theyll cling You traded cryptocurrency Using the reddit search The crypto tax procedure with Many went mad taxes procedures for digital currencies can be not an easy deal.

Remaining units 75-50 25 so we need to include 25 units from the earlier sale to calculate our start balance. Indian government just announced that crypto will be taxed at 30 of gains. Not only can we handle 400 exchanges and wallets but we also work with all non-exchange activity such as onchain transactions like Airdrops Staking Mining ICOs and other DeFi activity.

The internal revenue service irs recognizes any income generated by trading cryptocurrency or accepting cryptos for goods and services as taxable. It was developed with the. Business expenses will also not be allowed.

You simply import all your transaction history and export your report. Initial purchase price of 5 x 25 units 125. Whether you are filing yourself using a tax software like simpletax or working with an accountant.

Tax treatment of cryptocurrency for income tax purposes. Whether you are filing yourself using a tax software like simpletax or working with an accountant. If your crypto tax situation ever gets more complex feel free to try us out at cryptotaxcalculatorio were an Aussie-made crypto tax solution.

9 best crypto tax calculator tools cryptotradertax plus promo code. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. REEallly small crypto interest and taxes.

Check out Zenledger. I mostly just use Koinly to find the market values at the time of my transactions and to have the value of my portfolio on my phone using the Android app. An online crypto tax manager.

Blox free Pro plan costs 50K AUM and covers 100 transactions. Take the initial investment amount lets assume it is 1000. You can discuss tax scenarios with your accountant.

Business expenses will also not be allowed. The tax will apply to all gains on digital virtual assets and no capital losses will be allowed. Coinbase Adds Cryptocurrency Tax Calculator Crypto Daily from cryptodailycouk.

Nevertheless Coinbase has found a solution for its customers a new tax calculator. Your crypto tax report pricing. CoinLedger is another great Crypto tax tool for traders and investors looking for simple and intuitive crypto tax software.

If a user has been investing in decentralized finance defi protocols the process could take even longer and be significantly more difficult. Bitmex bybit and other crypto derivatives platforms has got tools to calculate the profit loss and to estimate the liquidation cost beforehand. This is the first time the Indian government is discussing crypto taxation.

Finance minister nirmala sitharaman has announced that income from digital asset transfer will invite tax at the rate of 30 in the union budget. I was getting DAI in small amounts via an interest account on CB daily. Crypto tax calculator reddit.

Your income bracket and how long you have held the cryptocurrency.

How To Calculate Crypto Taxes Koinly

Rp2 Status Privacy Focused Free Open Source Us Tax Calculator R Cryptotax

Crypto Mining Taxes What You Need To Know

Start Options Step Up Your Game Stock Options Trading Options Trading Strategies Investment Advice

Best Crypto Tax Software Top Solutions For 2022

Crypto Tax In 2020 A Comprehensive Guide En 2020 Guide Autorite

Crypto Tax In 2020 A Comprehensive Guide En 2020 Guide Autorite

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

New Partner Cryptotaxcalculator Deribit Insights

Digital Decentralization Is Just The Beginning The Real World Will Follow Bitcoin Mining Pool Historical Data Mining Pool

Bitcointaxer Org Open Source Crypto Tax Calculator And Portfolio Tracker R Cryptotax

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Coinboard On Twitter Bitcoin Crypto Money Cryptocurrency

Sharing My Tax Calculator For Ph R Phinvest

Crypto Tax Calculator Overview Youtube

22 Best Reddit Personal Finance Communities For Entrepreneurs And Business Owners Personal Finance Finance Finance Guide